VAT Report

How to view VAT Report?

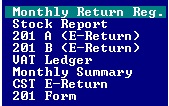

- Go to Reports > VAT Report and press Enter Key.

- Move cursor to the required report, press Enter Key.

- Monthly Return Register:

- Move cursor to "Monthly Return Reg."

- Other Class: Y: To include other class in report.

N: Not to include other class in report.

- Press Enter key & Select Printing options & press Enter Key to view report.

- Stock Report:

- Move cursor to "Stock Report"

- 201 A (E-Return): ( List of Sales of goods)

- Move cursor to "201 A (E-Return)"

- Select Sales book

Period |

Mention time period between which you wish to view report |

|

Other Class |

|

|

Manual upload file? |

|

|

Round off net amount? |

|

|

Wise |

Item Bill |

To view report item-wise To view report bill-wise |

Report |

New Old |

To view report in new format To view report in old format |

- Select printing options, press Enter key.

- 201 B (E-Return):( List of Purchase of goods)

- Move cursor to "201 B (E-Return)"

[To enable VAT, press “Alt+X”, select VAT %, press Enter key.

Or

- Under "Masters" Menu, Open Account.

- Select Criteria under VAT Information.

- All books under the account will be updated.

Or

- Open "Sale" or "Purchase" under "Transaction" Menu.

- Select "VAT class".

- Select "VAT Invoice type".

Normal: To apply VAT on the net amount.

Net Rate: To show amount inclusive of VAT.

VAT after Discount: To apply VAT after applying discount on item.

Calculate All: to apply VAT on the total amount.]

Created with the Personal Edition of HelpNDoc: Easily create iPhone documentation