TDS Certificate

Note: As per the TDS adjustment, the system generates a certificate, which is known as the TDS Certificate.

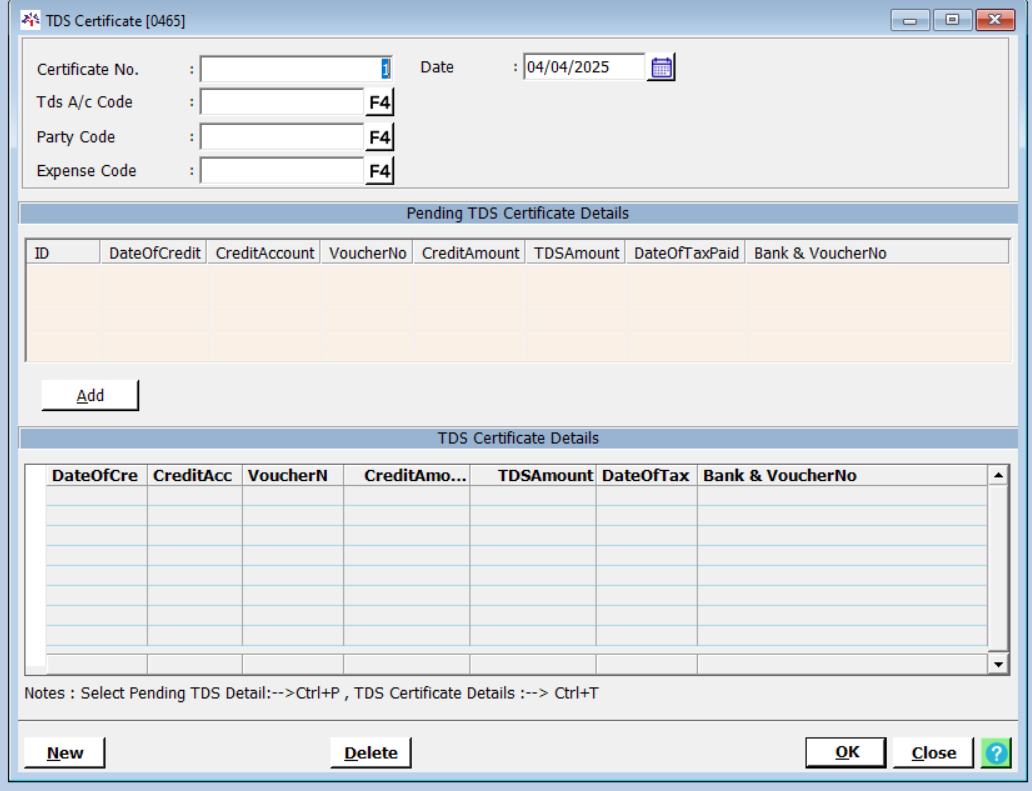

- After logging in to the Company Main menu, go to Transaction> Tax > TDS > TDS Certificate.

- TDS Certificate form will open. Enter the following details:

Certificate No. |

Enter the certificate number. |

Date |

Enter the certificate date. |

TDS A/c Code |

Select the TDS (Tax Deducted At Source) Account Code. |

Party Code |

Select the party code. |

Expense Code |

Select the expense code. |

Pending TDS Certificate Details |

ID |

It displays the ID number. |

Date Of Credit |

It displays credit date. |

|

Credit Account |

It displays credit account. |

|

Voucher No |

It displays voucher number. |

|

Credit Amount |

It displays credit amount. |

|

TDS Amount |

It displays TDS Amount (Tax Deducted At Source). |

|

Date Of Tax Paid |

It displays the date when the tax is paid. |

|

Bank & Voucher No |

It displays bank and voucher number. |

TDS Certificate Details |

Date Of Credit |

It displays credit date. |

Credit Account |

It displays credit account. |

|

Voucher No |

It displays voucher number. |

|

Credit Amount |

It displays credit amount. |

|

TDS Amount |

It displays TDS Amount (Tax Deducted At Source). |

|

Date Of Tax Paid |

It displays the date when the tax is paid. |

|

Bank & Voucher No |

It displays bank and voucher number. |

Created with the Personal Edition of HelpNDoc: Free Qt Help documentation generator